-

High transaction throughput

-

Fast block time

-

Competent core team

-

Established partnerships and dapps

Lower ranks are better

High transaction throughput

Fast block time

Competent core team

Established partnerships and dapps

The project is still in its early stages and is starting with an ERC20 token

It's too centralized and codependent on both the team and the partners (banks and dapps)

Penetrating the e-commerce market

Taking the market share of the current DeFi space

Potential for revenue streams in the remittance market.

The project heavily depends on the performance of the team behind the project due to its centralized design

If the regulatory climate changes, the whole system must adapt to comply with the new requirements.

Technical Analysis by Kong Trading - 22/10/2020

RFUEL has been moving very strongly lately. The downtrend is massive and becoming slowly exhausted and ready to break. Looking at the structure, one can see multiple breaks of key-areas of support and rejections at the downtrend resistance. The most recent break of the key-area of support was not very heavy and seems more like a fakeout, not like a breakdown.

To read the full Technical Analysis from Kong Trading click here.

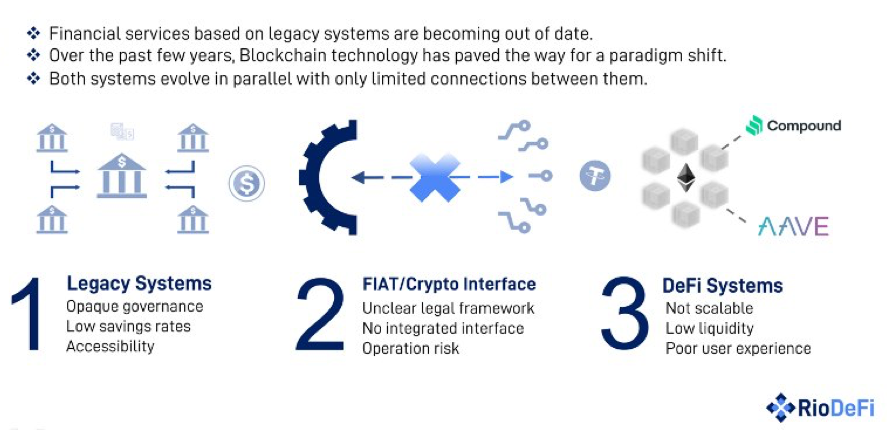

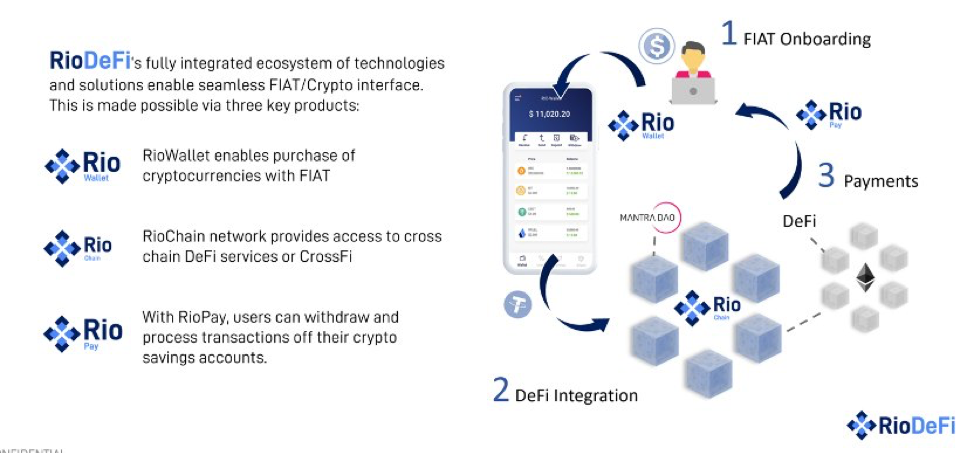

RioDeFi is a technological company behind Rio Chain that aims to bridge the gap between decentralized and centralized finance by connecting business, financial institutions, and banks to the blockchain. With its unique hybrid federated blockchain model built with the Substrate software development framework, it creates a block every 2 seconds. It is interoperable as it utilizes Polkadot’s cross-chain compatibility. It uses a consensus mechanism called Proof of Authority, which allows for a transaction speed of over 3000 transactions per second as it adopted Substrate’s Aura and GRANDPA algorithm.

RioDeFi solves the problem of slow speeds, low transaction throughput, lack of user-friendliness, and incompatibility with existing systems by taking a more centralized approach in the blockchain design. Thus all the parameters are set, run, and managed by the foundation and its starting participants.

It will provide a base layer for an ecosystem of decentralized finance applications. These solutions will include many popular financial products and services, such as lending, borrowing, payment gateways, stablecoins, e-commerce, etc. Dapps will be written in the RUST programming language that is intended to be used for large systems and protect their integrity.

Rio Chain is the base layer on which the Rio DeFi ecosystem is going to be built. This is a set of already developed decentralized finance applications that will be launched from the very start and are created by the partners of the project. One of these is MANTRA DAO that provides a wide range of services that include staking, lending, stablecoins, derivatives, governance, grants, and custody.

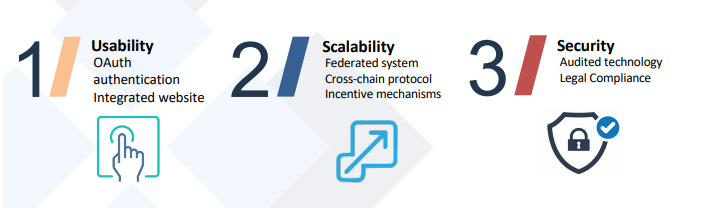

Rio Chain is built with scalability, interoperability, and upgradability in mind. Thus it has taken a more centralized approach with the blockchain and consensus model. It has a hybridized model between a permissionless and private that’s called a hybrid federated model.

Often seen as the solution for financial services, it introduces many actors, unlike in the private blockchain, where only one can grant permission. These actors (users, organizations) are called federation hence the name.

It is built with the help of Parity’s Substrate framework, which enables compatibility with the Polkadot’s parachains built on Substrate. This is how it can achieve cross-chain interoperability through Polkadot’s interoperability solution.

Designed in this way with block creation occurring every 2 seconds and, Rio Chain can increase the transaction throughput. Currently, it is looking at 3000 TPS but has the potential to increase it over time. The Federated model ensures long-term scalability and lower transaction costs, and a secure environment in which there aren’t possibilities of 51% attacks.

Transactions are validated by the Proof-of-Authority (identity-based) consensus mechanism that combines the Substrate framework Aura (Authority Round) and GRANDPA (GHOST-based Recursive ANcestor Deriving Prefix Agreement). Because the network nodes are semi-private, a random Authority (node) is selected to validate the transaction and that only block data with Aura consensus and blockchain finality with GRANDPA. The split of the block data writing and finality verification processes brings more flexibility.

There are four types of transaction fees on the Rio Chain:

1) Base Transaction Fee: A fixed value is charged for each transaction.

2) Byte Transaction Fee: Charges are based on the size of each byte.

3) Weight Fee: Charge according to the specified transaction weight.

4) Tips: Users can pay tips to increase the priority when packaging a transaction.

In the beginning, Rio Chain will only employ the base transaction fee method, which is currently fixed at 0.1 Rio Fuel (RFUEL).

Rio DeFi is for the general public interested in decentralized financial services like lending, borrowing, payments, and e-commerce. The goal is to make (decentralized) financial services more accessible by bridging the gap between traditional and decentralized economies.

It is a blockchain technology layer that enables the creation of the vast ecosystem of decentralized applications, thus it can also be used by developers and organizations to utilize its high transaction throughput to facilitate e-commerce and payments, including fiat to crypto and vice versa.

Rio DeFi’s cornerstone product is its blockchain on which decentralized applications are going to be built. Rio Chain, when compared to other blockchains, represents a shift in network design and development philosophy. Thus it has some key features.

Block creation time - 2s

Transactions per second - 3000

Flexible consensus mechanism - Combining two consensus algorithms, one for block data and other for blockchain finality.

Interoperability - Utilizing compatibility with Polkadot’s parachain solution to enable the project to be built on top of the Rio Chain can be easily deployed to communicate with other chains.

Upgradable - It separates runtime components, allowing easy runtime upgrades without the need for a hard fork.

Besides the ones that are making it distinct as a blockchain platform Rio Chain also has some unique blockchain features. Each transaction is publicly stored on the ledger and can be easily traceable with the wallet and the block explorer. Smart contracts enable the creation of the decentralized applications and can be written in Rust programing language but also in C/C++, C#, Typescript, Haxe, and Kotlin.

Rio DeFi application can be segmented in three primary use cases:

1) Financial Applications

2) Decentralized E-commerce

3) Payment Solutions

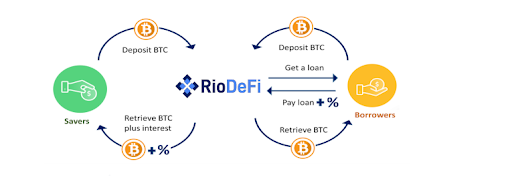

As a blockchain that mainly focuses on hosting decentralized finance applications, its primary use case is powering these applications. There are use cases for Bitcoin lending, Bitcoin savings account, loan programs, etc. Everything you can think of as decentralized finance the Rio Chain is equipped to provide as a base layer.

The second major use case is in the E-commerce industry. Decentralized e-commerce would mean to disrupt the monopoly of the current platforms that merchants need to use to reach their customers. Not only that, but they are paying high fees and lack vast user data on which they can rely on insights to create sound strategies and drive further profit.

The third major use case is the crypto-fiat gateway. This is a highly significant one because the market still experiences problems with on-ramping new users. This is due to the lack of regulatory frameworks and trust between exchanges and the government’s financial authorities. Exchanges require KYC procedures but are rarely 100% compliant with the laws, and thus banks often refuse to provide a reliable service. Rio DeFi tackles this problem from the very start. Instead of working against the banks, they are working with the banks to help bridge the gap between the money markets by combining traditional and decentralized finance practices. This is only possible because of a more centralized blockchain design the projects have maintained.

|  |  |

As a DeFi platform with other features like a digital wallet, payments, merchant services, an exchange, RioDeFi’s immediate competition are other DeFi coins and platforms.

Rio DeFi has an international team with backgrounds in blockchain, finance, communications, design, and software development. Coming from diverse but related and relevant backgrounds they are complimenting the team with different but equally important sets of expertise.

There are four co-founders with four different key roles.

Besides these fours co-founders that have taken key roles in the development of the projects the team consists of more experts in other fields: Argu Lin, Technical Director; Phyrex Ni, Managing Directors China; Stacie Meng, Partnership Director; Harrison Cheung, BD Director; Shahen Markarian, Product Designer; Billy Magbanua, Product Manager.

Dr. Gino Yu - PhD in Electrical Engineering and Computer Science at Berkeley, chairman and co-founder of the Hong Kong Digital Entertainment Association.

Sunny Cheung - has nearly 20 years of experience in the TMT space and over 10 years of investment experience

Will Corkin - a blockchain & fintech entrepreneur with a background in portfolio management he helped to structure and launch over 20 blockchain companies.

John Patrick Mullin - a FinTech entrepreneur, tokenization expert, and educator living in Hong Kong. Has a background in investment banking and was the founding team member and Managing Director of trade.io a cryptocurrency exchange and advisory firm based in Hong Kong.

Jamie Cheng - Full stack developer and bitcoin investor since 2013 he is the former Founder of BitPortal Wallet.

In order to incentivize its users to maintain the network, Rio Chain has its native token RFUEL. Besides node compensation for keeping the blockchain records, Rio Fuel is also used to pay transaction fees, execute a smart contract, and to fuel the network.

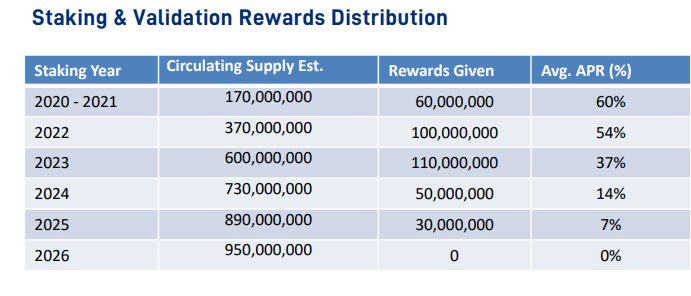

There are 1 billion tokens minted at the very start, out of which 70% will be emitted as rewards while out of the remaining 30%, 20% will be sold in public and a private sale, and 10% will be maintained as reserves that will slowly release over five years.

A more detailed allocation table can be found below.

Locked tokens in the amount of 5% of the total supply will only be distributed to the first 5 million unique wallets at the rate of 10 RFUEL per address and are only used on the platform for transaction fees.

150 million RFUEL that go to the Rio DeFi Team & Advisors (15%) will be vested for a 2-year period. In the first 6 months, no emission would be made while after 1/18 of the total amount per month over the following 18 months will be released.

The tokens from the private sale (15%) will be vested to over 151 days, out of which 1/6 will be released on Token Generation Event (TGE) and days 31, 61, 91, 121, and 151 after TGE.

350 million RFUEL (35%) will be distributed to those staking RFUEL and validating the network's transactions. The APR generated through staking will vary depending on the staking year and the total % of staked RFUEL.

Since Rio Chain will host a wide range of dapps that will drive the user base of the network, it is giving part of the transaction fees back to the dapps. 80% of the RFUEL is going to the node operators, while 20% is going back to the dapps themselves. This is an attempt to incentivize developers to create for the Rio Chain and increase the network's transaction activity.

Rio DeFi starts with an ERC20 token on the Ethereum blockchain and will later switch on the mainnet. The public sale was divided into a pre-sale and three rounds with different terms and price points.

Pre-sale was conducted on the 7th of September for the holders of the MANTRA DAO's OM token who staked their coins to signal the interest and support. The price was set at $0.06 and was sold on a first-come-first-served basis. With the min-max contribution at $1000-5000, the tokens that were only to the OM token stakers are vested for a period of 12 months and are to be released at the rate of 1/12 per month.

The first round of the public sale was conducted on the 11th of September and with the token price set at $0.16. Min-max contribution was again from $1,000, but the max was set to double in cap $10,000. Tokens sold on the first round are vested up to 61 days and are to be emitted at 1/3 at TGE and at days 31 and 61. In it, the project raised its first target of $1200000.

The second round was scheduled for the 15th of September with the token price set at $0.18 and the same min-max cap as the previous one. Tokens sold at the second round have a lock-up period of only 1 month and are unlocked at the rate of 1/4 at TGE and days 11,21,31. This round has also successfully raised the target of $1350000.

The third round was to be conducted on Uniswap on the 17th of September at the price point of $0.20. These tokens are fully unlocked.

The market potential for Rio DeFi is as massive as the whole DeFi space. Sitting currently at around 9.5 billion dollars (Total value locked), the decentralized finance space has increased from 1.8B since the start of July and is expected to continue its growth.

As the project aims to be a hub for decentralized finance for dapps and users, position in the middle of the most active market will surely reap its benefits. With clear advantages of high transaction throughput, fast block time, and bank cooperation, it definitely has the potential to take a significant percentage of the market share.

Another competitive advantage that the project brings with bank cooperation is cross-border payments. These transactions have increased by around 9% from the last year and are expected to reach $2.9 Trillion in revenue annually by 2022. With its product Rio Pay, the company is likely to tap into this revenue stream as well.

+0

2 years ago

Rio DeFi doesn’t have a significant social media presence although they have all of the accounts. The biggest number of people that are following the project are on their Telegram channel where all the major announcements have been made like the one regarding the public sale. The secong biggest audience is on Twitter.

http://riochain-media.oss-cn-hongkong.aliyuncs.com/Rio_DeFi_Whitepaper_English.pdf

https://icodrops.com/wp-content/uploads/2020/09/RioDeFi-Sale-Details.png

https://medium.com/@riodefiofficial/rfuel-community-crowdsale-update-2597bde0f307

NO INVESTMENT ADVICE

The content is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Upblock or any third party service provider to buy or sell any cryptocurrencies (also called digital or virtual currencies, crypto assets, altcoins and so on).

DO YOUR OWN RESEARCH

Our content is intended to be used and must be used for informational purposes only. It is essential to do your own analysis before making any investment based on your circumstances. You should take independent financial advice from a professional in connection with or independently research and verify any information that you find on our website and wish to rely upon, whether to make an investment decision or otherwise.